Business

TCOA Workshop 2025 Promises with “Trade Secrets Revealed” Training Program.

The Television Content Owners Association (TCOA) successfully fulfilled its 2025 commitments to its members with the annual internal training program, “Trade Secrets Revealed: Industry Leaders Share Their Experiences.” The event, held on July 3, 2025, at the PefTI Multipurpose Hall, proved to be an engaging and informative experience for all attendees.

The program commenced with the national anthem, followed by a welcome address from the association’s First Vice President, Mrs. Moyinoluwa Olutayo. Her remarks effectively set the stage for a day of learning and networking. Mr. Emdee David, the Master of Ceremonies, then introduced the esteemed guest speakers: Chief Mr. Wale Adenuga MFR, Mrs. Ijeoma Onah, and Mr. Olatunbosun Olaegbe. While Otunba Sesan Rufai was regrettably unable to attend, the assembled panel represented a wealth of industry expertise. Interspersed throughout the program were captivating performances by PefTI art students, including live bands and other engaging presentations, adding an element of entertainment to the day’s proceedings.

The core of the event was the keynote session, expertly moderated by Ms. Busola Olugbemileke. Chief Mr. Adenuga, Mrs. Onah, and Mr. Olaegbe shared their personal career journeys, highlighted their contributions to the industry, and openly discussed the challenges they faced. Their collective insights offered valuable and actionable advice to both seasoned professionals and those newer to the content creation landscape.

An interactive Q&A session followed, allowing attendees to delve into pressing issues such as adapting to digital platforms, effective content monetization strategies, and optimal distribution methods. The panelists provided thoughtful responses on topics ranging from production quality and business development to the importance of strategic networking. In response to a question about the relevance of the association’s name, Mr. Olaegbe clarified that the Television Content Owners Association encompasses content across various platforms, emphasizing that “content is life.” This statement resonated deeply with the audience, underscoring the fundamental importance of content creation in the modern media environment.

The session concluded with key takeaways, emphasizing the need to understand target audiences, tailor content accordingly, and advocate for government support to elevate content production standards within Nigeria. The importance of careful platform selection to maximize investment returns was also highlighted.

The TCOA 2025 internal program concluded on a high note, leaving participants feeling inspired and well-informed. A wrap-up session featuring WAP TV correspondents, coupled with light refreshments, provided a fitting end to a successful and impactful event.

Below are some pictures from the Event:

Business

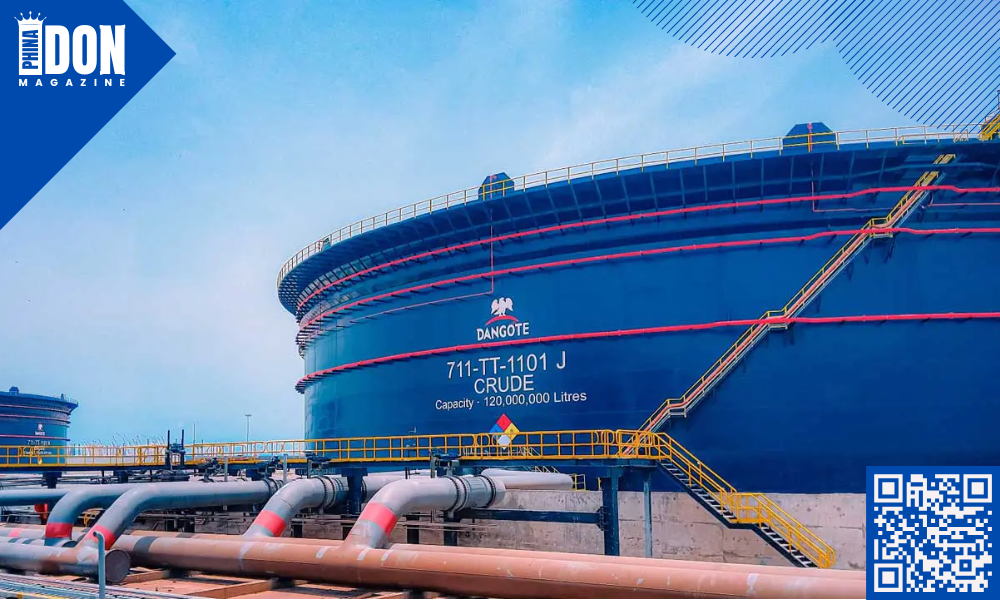

Dangote Refinery Announces Further PMS Price Reduction.

Dangote Refinery has announced a further reduction in the ex-depot price of Premium Motor Spirit (PMS), bringing it down to N835 per litre from the previous N865. This N30 decrease, communicated to customers via notice on Wednesday, follows a reduction to N865 just six days prior.

This adjustment is expected to translate to lower retail prices at partner stations, such as MRS, with potential reductions from N940 per litre anticipated.

The price reduction coincides with regulatory approval for the importation of 117,000 metric tonnes of petrol between April 8th and 16th, 2025. However, industry analysts, including the Independent Petroleum Marketers Association (IPMAN), caution against expecting a drastic price crash due to demand/supply dynamics and foreign exchange fluctuations, even with the renewal of the naira-for-crude deal.

Business

Nigeria’s Public Debt Burden Significantly Increases.

Nigeria’s public debt has experienced a substantial surge, reaching N144.67 trillion by December 2024, a 48.58% increase from the N97.34 trillion recorded at the close of 2023. This data, released by the Debt Management Office, indicates a year-on-year increase of N47.32 trillion and a quarter-on-quarter rise of 1.65%.

This escalation is primarily attributable to increased external and domestic borrowing. External debt rose by 83.89% to N70.29 trillion, while domestic debt increased by 25.77% to N74.38 trillion. The Federal Government accounts for the majority of both external (N62.92 trillion) and domestic (N70.41 trillion) debt.

This significant increase in Nigeria’s debt profile has prompted concern among financial experts, particularly regarding the country’s capacity to manage this growing burden amidst existing infrastructural deficits. The implications of this rising debt for Nigeria’s economic stability and future development remain a critical area of analysis.

Business

The true factors behind the significant appreciation of the Naira against the dollar, according to the CPPE.

In recent weeks, the Naira has experienced significant appreciation against the U.S. dollar, a development largely attributed to enhancements in Nigeria’s external reserves and proactive measures implemented by the Central Bank of Nigeria (CBN). Muda Yusuf, Director of the Centre for Promotion of Private Enterprise (CPPE), elaborated on these factors in a statement released on Sunday.

As of last Friday, the Naira gained an impressive N127 to close at N1,535 per dollar, a stark contrast to its valuation of N1,660 just a week prior. This notable shift reflects both an increase in Nigeria’s external reserves, which have surpassed the $40 billion threshold, and the CBN’s strategic interventions to stabilize the currency.

Yusuf emphasized, “This improvement in our reserves implies that the CBN has greater capacity to intervene in the market. Indeed, we have witnessed the CBN intervene consistently.” The last five months have shown relative stability in exchange rates, which Yusuf considers a welcome trend. He noted that the improved reserve levels bolster investor confidence, further supporting the Naira’s strength.

The introduction of the Electronic Foreign Exchange Matching System (EFEMS) has also been pivotal in enhancing market stability. Coupled with governmental successes in the international finance arena—most notably, the recent $2.2 billion Eurobond issuance—the conditions for a robust Naira have been bolstered.

As the economic landscape continues to evolve, the CPPE remains optimistic about the trajectory of the Naira and its potential for further stability in the foreign exchange market.

I.A.U.

July 8, 2025 at 2:07 pm

This is awesome.