News

Oyedele outlines 10 advantages of tax reform bills for Nigerians.

The ongoing discourse surrounding President Bola Tinubu’s tax reform bills has ignited considerable debate, particularly among Northern governors and various regional groups who express strong opposition to the proposed legislation. However, Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has articulated ten key benefits of these bills, which are currently under consideration by the National Assembly.

In a statement shared via his official X account, Oyedele emphasized that the tax reforms aim to enhance the fiscal landscape of Nigeria while alleviating the burden on low-income earners. Notably, individuals earning up to N83,000 monthly will be exempt from the Pay As You Earn (PAYE) tax, and those earning less than N1.7 million annually will see a reduction in their PAYE obligations.

The proposed bills also include several provisions designed to support households and individuals, such as the implementation of a zero percent value-added tax (VAT) on essential services and goods, including food, healthcare, education, and transportation. Additionally, there are provisions for VAT exemptions on transportation, renewable energy, and essential household products.

Oyedele outlined the benefits of the tax reform bills as follows:

1. Complete exemption of low-income earners (up to N1 million per annum) from PAYE.

2. Reduced PAYE tax for those earning less than N1.7 million annually.

3. Zero VAT on food, healthcare, education, electricity generation, and transmission.

4. VAT exemption on transportation, renewable energy, CNG, baby products, sanitary towels, rent, and fuel products.

5. Tax breaks for wage awards and transport subsidies for low-income earners.

6. Tax incentives for employers to increase hiring compared to the previous three years.

7. Exemption of stamp duties on rent below N10 million.

8. PAYE tax exemptions for members of the armed forces engaged in combating insecurity.

9. Tax-friendly regulations for remote workers and digital nomads.

10. Clarification on the taxation of digital assets to prevent double taxation and allow for loss deductions.

These bills, which include the Joint Revenue Board of Nigeria (Establishment) Bill, 2024; Nigeria Revenue Service (Establishment) Bill, 2024; and the Nigeria Tax Bill, 2024, are designed to revamp the country’s tax laws and stimulate economic growth by benefiting small businesses, investments, and subnational entities. As the bills progress through the legislative process, their potential impact on Nigeria’s fiscal policy and economic landscape remains a topic of significant interest and discussion.

News

Federal Government Declares State of Emergency on Suleja-Minna Road.

The Federal Government has declared a state of emergency on the construction of the Suleja-Minna road. Minister of Works, David Umahi, announced the declaration on Saturday following an inspection of the road. He stated that the project, initially awarded to Salini Nigeria Limited, had been poorly executed or abandoned.

Umahi explained that despite repeated attempts to have Salini repair the road over the past year and a half, progress had been unsatisfactory. Niger Governor Mohammed Bago raised concerns with President Bola Tinubu, prompting the Ministry of Works to intervene. The road, described as being “in a very terrible situation delaying travel time by seven hours instead of an hour and half hours and vehicles are falling and killing people,” has been designated an emergency project.

The contract with Salini has been irrevocably terminated due to substandard work. Umahi has directed his ministry to recover funds owed by Salini, potentially involving the Economic and Financial Crimes Commission (EFCC). Two contractors are now engaged in the project. CCCC International Engineering Nigeria Ltd. has been contracted to handle part of the road, with 60km already completed under the Governor’s urban renewal agenda. CCCC has been given 10 days to mobilize and commence work on a critical 7km stretch. Umahi emphasized that work will begin immediately under emergency procurement guidelines, with pricing to be verified subsequently.

Entertainment

Nollywood Mourns the Loss of Kayode Peters.

The Nigerian film industry is in mourning following the death of Kayode Peters, a renowned filmmaker and producer. The news was announced by his family on his official Instagram page, stating that he passed away peacefully on the morning of Saturday, June 28, 2025, in Toronto, Canada, after a long illness.

Peters, fondly known as KP, was celebrated for his contributions as a filmmaker, actor, and producer. He was known for his role as Koko in the popular sitcoms “Twilight Zone” and “Flatmates” in the early 2000s. His work also extended to stage plays and sitcoms like “Extended Family” and “Being Farouk,” significantly impacting Nigeria’s contemporary theatre and television landscape.

He is survived by his wife, Alexander, and their children. Funeral arrangements are underway, and further details will be shared by the family in due course. The industry and fans alike will deeply miss his warmth, generosity, and contributions to Nollywood.

News

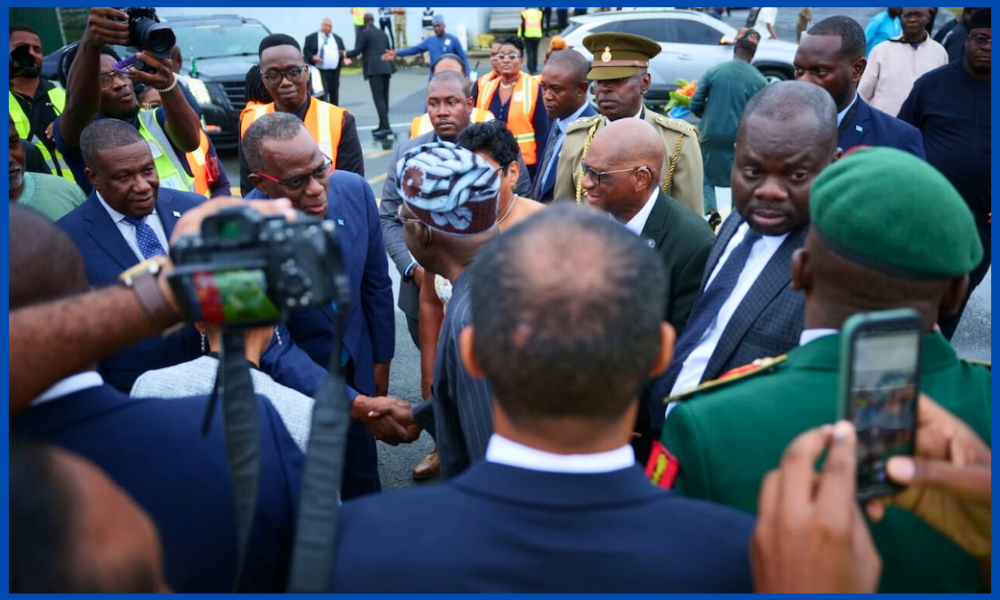

President Tinubu Begins Two-Nation Tour with State Visit to Saint Lucia.

President Bola Tinubu arrived in Vieux Fort, Saint Lucia, on Saturday, marking the commencement of a two-nation tour encompassing the Caribbean and South America. Upon arrival at Hewanorra International Airport, he was received with full military honors by Governor-General Errol Melchiades Charles and Prime Minister Philip J. Pierre.

The President’s itinerary includes courtesy visits to the Governor-General and Prime Minister, followed by an address to a joint session of the Senate and the House of Assembly of Saint Lucia. Discussions will focus on deepening cooperation between Nigeria and the Organisation of Eastern Caribbean States (OECS), with emphasis on economic partnerships and cultural solidarity. A visit to the Sir Arthur Lewis Community College is also planned to strengthen educational ties.

Following his engagements in Saint Lucia, President Tinubu will proceed to Brazil to participate in the 2025 BRICS Summit in Rio de Janeiro, attending at the invitation of President Luiz Inácio Lula da Silva of Brazil. Nigeria’s participation as a ‘partner country’ underscores its commitment to strengthening diplomatic and economic relations on a global scale.

-

News2 days ago

News2 days agoNigeria’s tax reform bills rename FIRS to Nigeria Revenue Service.

-

News2 days ago

News2 days agoPresident Tinubu Begins Two-Nation Tour with State Visit to Saint Lucia.

-

Entertainment1 day ago

Entertainment1 day agoNollywood Mourns the Loss of Kayode Peters.

-

News1 day ago

News1 day agoFederal Government Declares State of Emergency on Suleja-Minna Road.